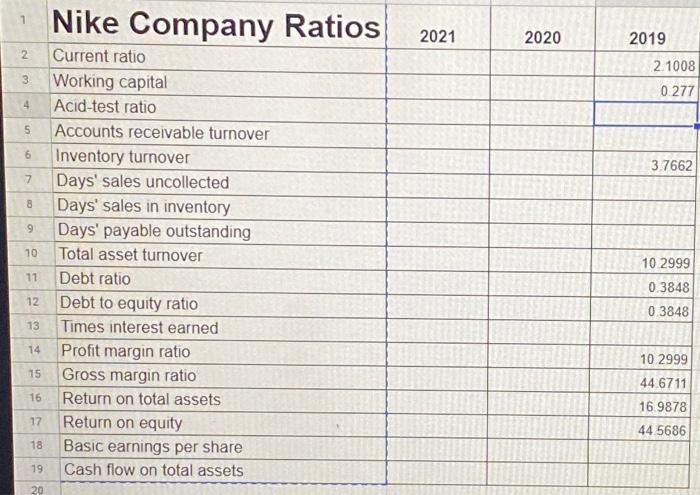

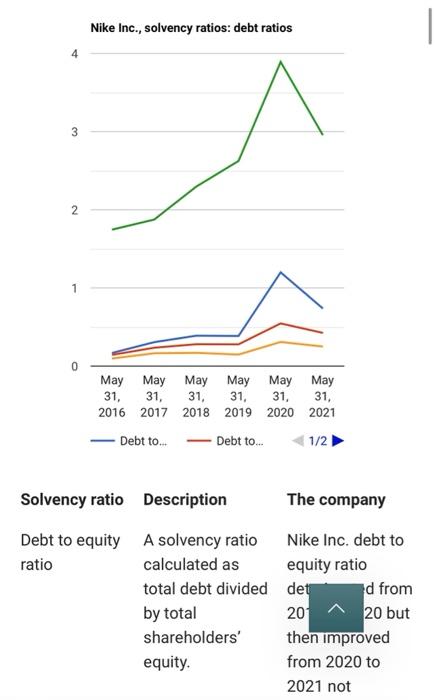

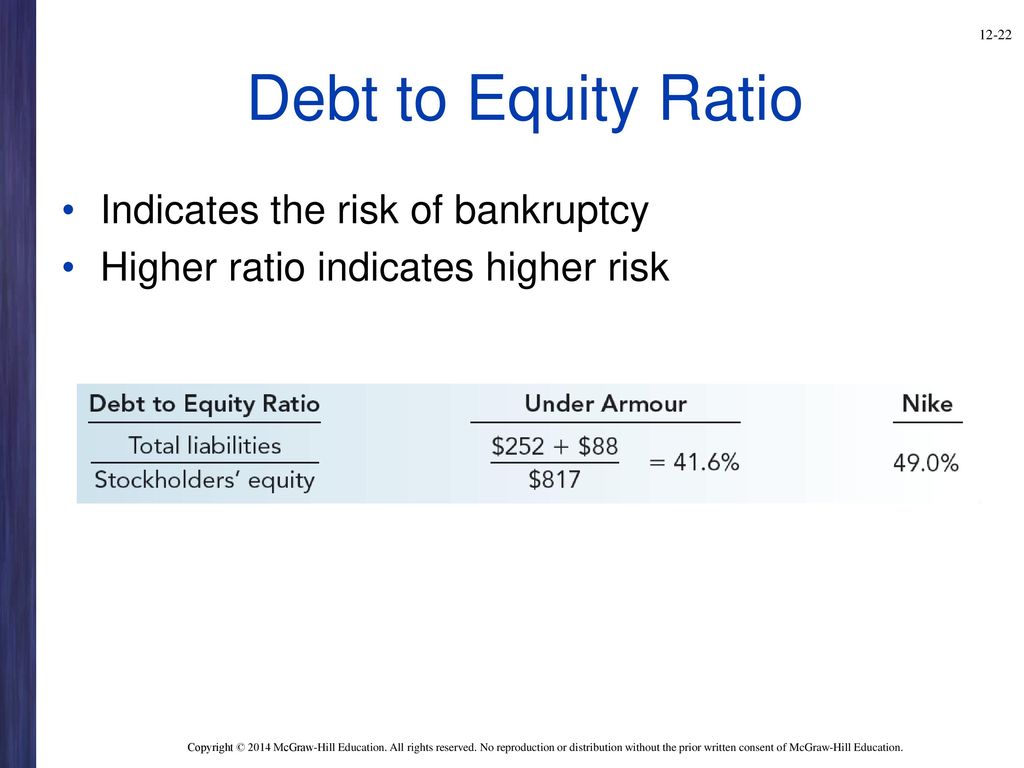

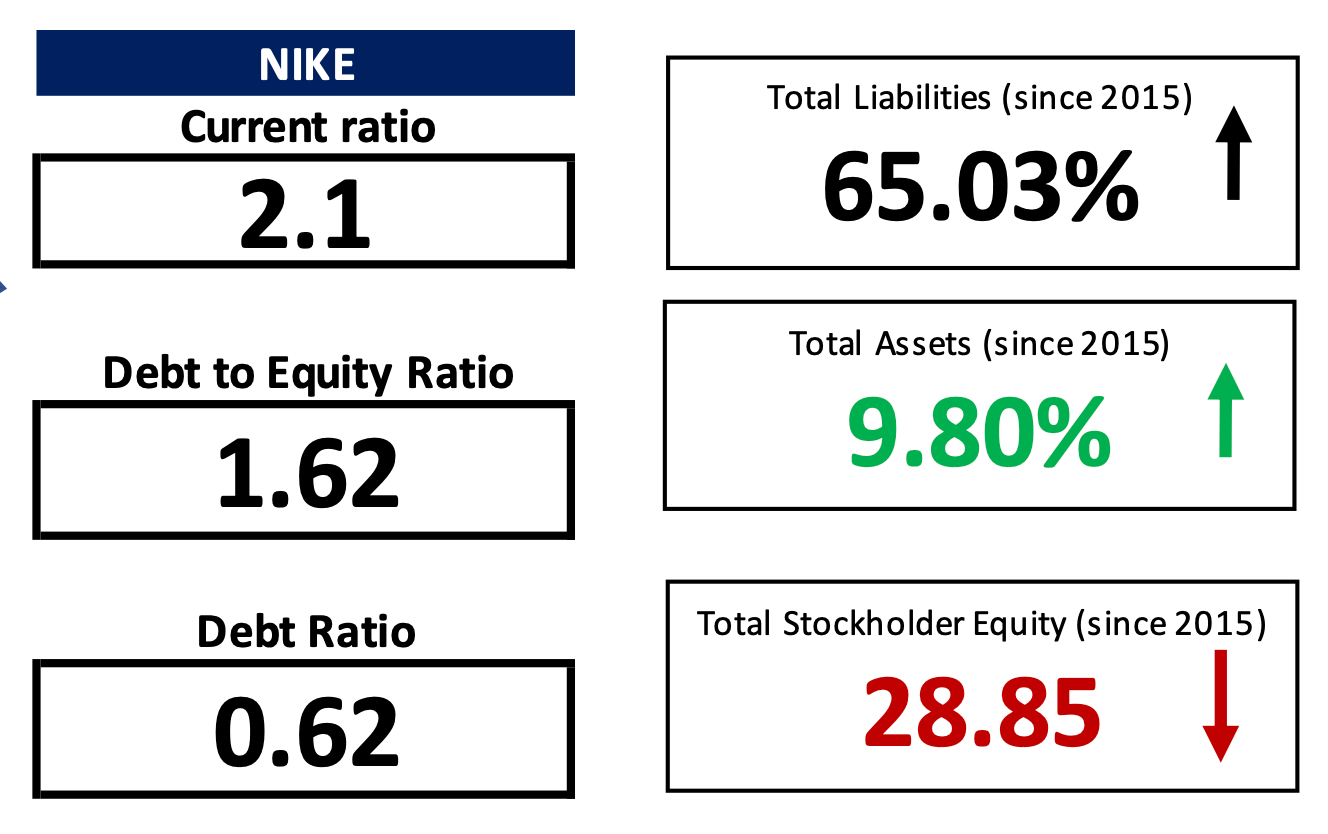

Nike, Inc Daniel Cibran ACG. Daniel Cibran ACG Annual Report Project Directions : Annual Report Project Directions : DURING THE CLASS. - ppt download

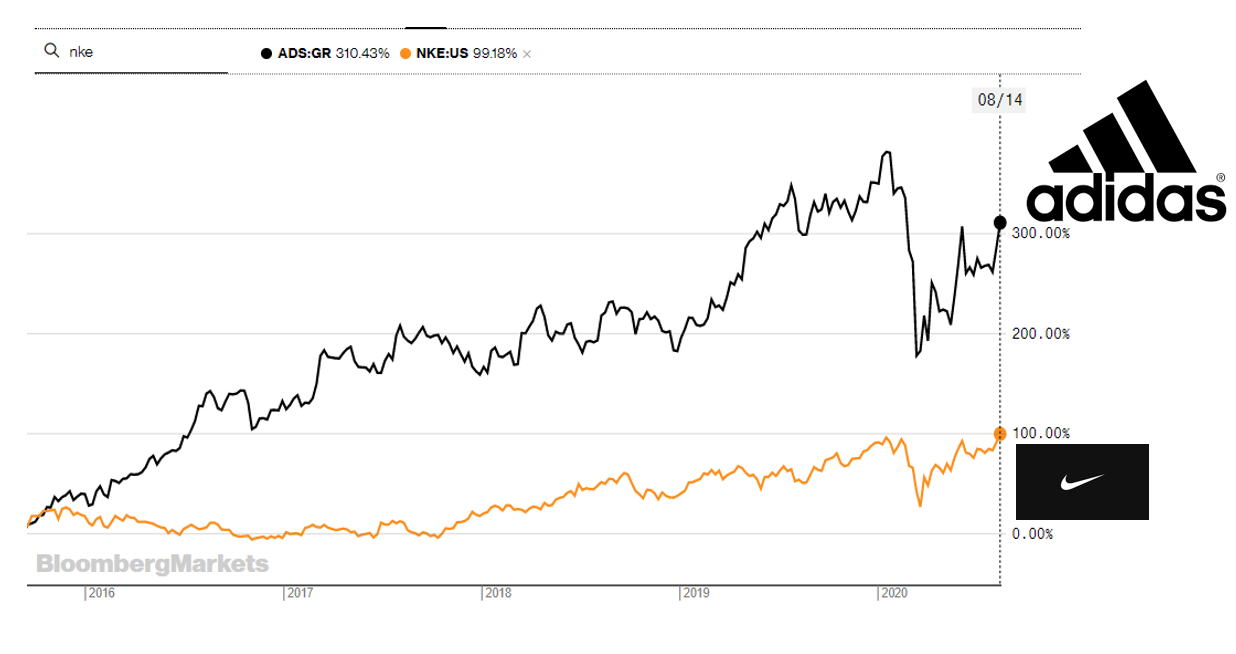

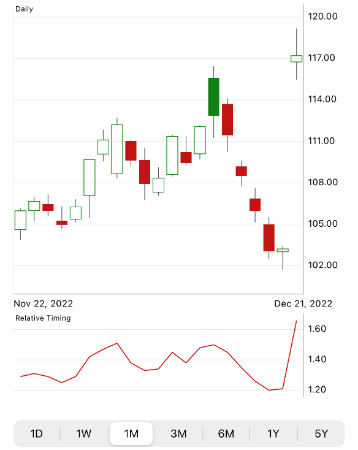

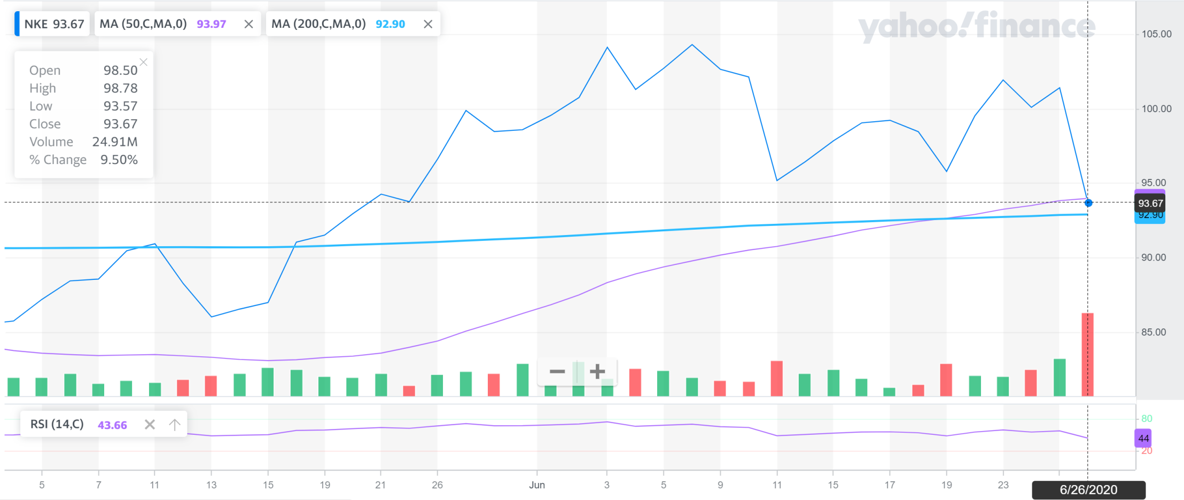

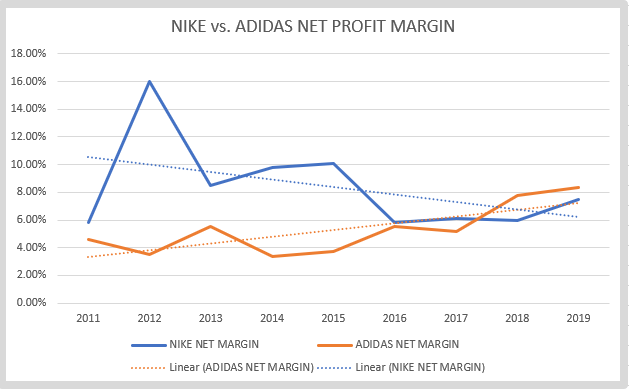

Nike vs Adidas: Where to Invest?. Nike and Adidas are both known brands… | by Kathleen Lara | Medium

:max_bytes(150000):strip_icc()/Long-TermDebttoCapitalizationRatio_v2-b70165af646d45b29590b1a852aa8876.jpg)